- Vast majority of world’s silicon chips come from Asia

- U.S. needs them for high grade military use

- Speed of China’s growth means U.S. wants control NOW

THE SUN, MOON AND STARS have all fallen into alignment over the past decade, creating the perfect conditions for a major conflict to break out—a war that many would hope would be unthinkable.

No, this is not about horoscopes.

The sun, moon and stars in this analogy are the elements of China’s economic and military advances, plus ongoing national developments, including:

- Expanding naval capacity, missile technologies and space programs;

- Its globalization program, the Belt and Road Initiative;

- Its rapid development in technology (think A.I. and 5G);

- And financial innovations that could produce digital money to counterbalance the US dollar as the world’s reserve currency.

Put it all together and the conclusion is inescapable: America’s global dominance has never been more at risk than it is now. The world’s wealthiest country will feel it must react, regardless of consequences.

THE TRIGGER

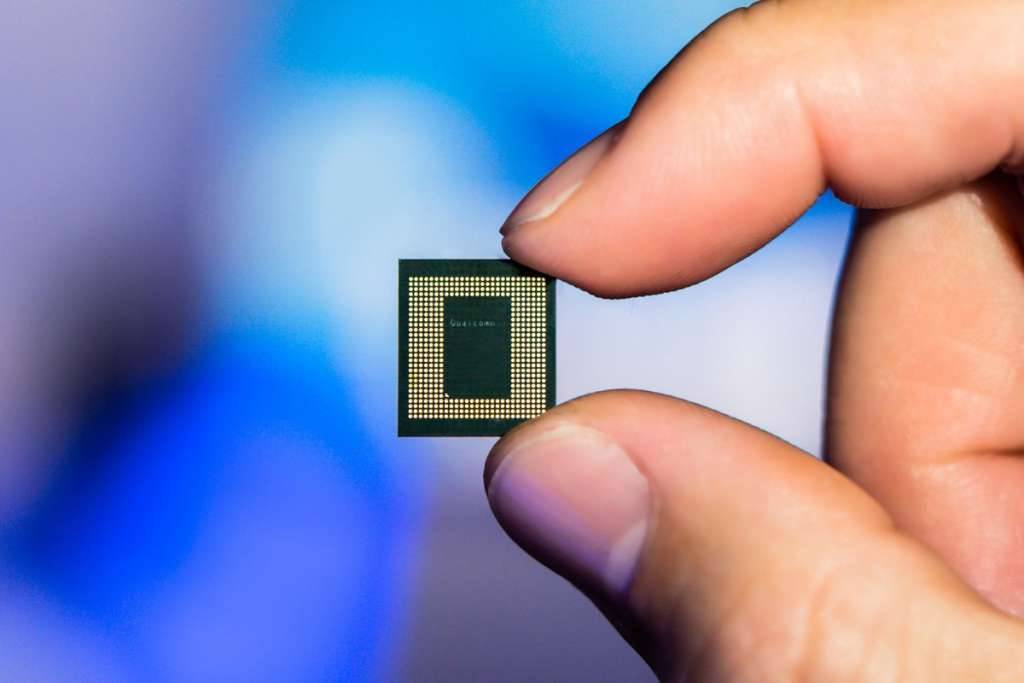

What will be the trigger? At the moment, it looks like being an object that’s smaller than your fingernail:

The semi-conductor.

Here’s the problem: Asia makes chips. Not just some chips, but the vast majority of the world’s semi-conductor supply.

The region produces a staggering 80% of outsourced semi-conductor manufacturing worldwide. Taiwan’s TSMC alone produces 50% of the planet’s semi-conductors: every electronic device you can think of uses them. You probably have some on your desk right now.

Other contributors include South Korea and Japan, and then there’s mainland China producing many of the lower end chips.

What about the West? The United States produces only about 12%. All the European countries put together have a mere 9%, down significantly from a height of 44% in the 1990s. In short, Asia rules the global industry, as you can see from the chart below.

This has suddenly become a hot topic—and a focus for investment. South Korea is pouring US$450 billion into its industry over the next 10 years. Over the next 10 years, China has committed U$150 billion that we know about, and that doesn’t include private capital.

And future projections? Unless a seismic shift or rebalancing takes place, it will likely be more of the same: Taiwan, mainland China, South Korea, and Japan are together currently on track to continue domination of the broader spectrum of the chip industry in the next few decades or longer.

THE MILITARY ANGLE

Here’s where things get interesting. The more sophisticated and complex chips, and particularly very sophisticated semi-conductors, are largely designed by US companies with US-owned technology.

While certain sensitive military and high-grade chips are manufactured onshore in US government-approved foundries, much of the general manufacturing and production is outsourced to Asia.

The result is a highly skewed supply chain which relies on the region that exposes significant vulnerabilities for American interests.

NEED FOR A CHANGE

Washington, naturally, wants to change this, doing more production at home. A bill was proposed some six months ago by the US to pump US$52 billion of taxpayers’ money into developing an indigenous US chip manufacturing capacity. TSMC has signed a contract with the US and is moving a proportion of manufacturing capacity to America.

That move is currently advancing with TSMC currently shipping more than US$4 billion worth of materials to Arizona. It’s a big deal: the US$52 billion is only part of the story. State governments will also pile in with investments, and private capital investments are also likely.

TSMC in Taiwan and many other chip companies have been requested/ ordered to provide materials and data to the United States by this month, November 2021

TECH SHOCK AROUND THE CORNER

But the fact remains: there is a serious tech shock around the corner. By this, I mean there is already a growing shortfall of all manner of chips globally. This is not because of supply chain issues, nor the pandemic. It’s supply and demand, with an increasing need for things containing chips in every industry.

A.I., for example, has increased chip usage and demand by 3,000 times since 2014. Add to this the emergence and increasing use of 5G in conjunction with increasing application and integration of A.I., machine learning and automation, and within the next five years even a modest doubling of demand will exponentially increase the pressure on the industry.

TAIWAN SUCKED IN

Taiwan is the core producer of these chips for the military and therefore finds itself in both an enviable position commercially and unenviable position politically. It is being sucked into a position of strategic integration within the US military industrial complex.

This brings us back to the current issue: Taiwan, Japan, South Korea, and China’s domination of the industry. What do you think would happen to the semi-conductor supply chain if there was a regional conflict?

A current real-time example is the current raft of supply chain issues dragging on the US at the moment, many of which are homegrown. These are sufficient to make the point that even small-scale disruptions can cause serious supply chain problems.

So a major disruption in the semiconductor supply chain would have massive implications for the entire world, not merely the technology sector. Countless elements of modern life would be disrupted.

WHEN WILL THE TROUBLE START?

The focus at the moment is timing. China is racing forward within the technology sphere and making the necessary technological developments within its military, navy, air force and space programs.

There are several specific factors to point out, among a plethora of risks. As the US and other countries make advancements in military technologies and their associated requirement for yet more sophisticated semiconductors increases, their defense reliance on Taiwan particularly, and Asia more generally, will also increase.

This will expose them to yet more strategic supply chain dependency vulnerabilities.

PEACE ALSO A PROBLEM

The risk, though, is not just about the potential of China annexing Taiwan, with the ensuing global disruption of semiconductor supply chains and the cutting of critical supply for commercial and military/defense use.

It is also about China reaching equilibrium with the US on a militarized capacity in the future. The potential for Chinese domination of the tech industry and within that an increased share of chip sectors, present a further future risk of unseating the US. The US will simply not just sit back and let this happen unchallenged.

But when to challenge it? That is really the crux of the issue.

GEOPOLITICAL FACTORS

This is where we need to circle back to the sun, moon and stars. How close are we to the full alignment of elements that would cause the US to take action over Taiwan, or goad China into doing so?

If it were as simple as the range of factors related to positioning and prepositioning outlined above, then we could breathe a slight sigh of relief, as war doesn’t appear immediately likely.

However, it is not that simple. There are other geopolitical and strategic factors also in play.

- The Chinese naval build up, in volume, but not tonnage, is alarming US strategists.

- Taiwan remains the central piece on the board as a prisoner of geography, fundamentally tied into the US 1st and 2nd Island chain containment strategy of China and Russia.

- China has vowed with increasing vigor to reunite Taiwan with the Motherland. An invasion would not have been militarily possible a decade ago, or even five years ago, without massive military and economic losses sufficient to cripple the Chinese economy and perhaps result in potential destabilization of the country. That has changed.

For the US and its allies, the loss of Taiwan within the 1st and 2nd island chain containment strategy would alter the balance of power in the Pacific and beyond. America would be forced out of Asia-Pacific as the hegemonic military power, which would greatly weaken its economic global hegemony.

Therefore, Taiwan is the critical piece for both sides for multiple reasons, but not least geography and technology.

Yet, who’d have thought tiny little semi-conductors would act as an unseen accelerator to potential conflict?

Phil Hynes is a regional risk analyst based in Hong Kong specializing in international geopolitics

LINK: US foments and finances anti-China sentiment in Hong Kong, Xinjiang and elsewhere in “long game” destabilization efforts

Image at the top: art by Fridayeveryday incorporating image by Michael Deziedzic/ Unsplash